6 Budget Revision Ideas for Empty Nesters

6 Budget Revision Ideas for Empty Nesters

After years of seemingly endless school events, grocery bills that could feed an army, and the hustle and bustle of family life, your house has suddenly become quiet. You’ve become empty nesters. You must adjust your spending and budgeting habits along with this significant lifestyle change. Let’s dive into how to revise your budget when you become are empty nesters.

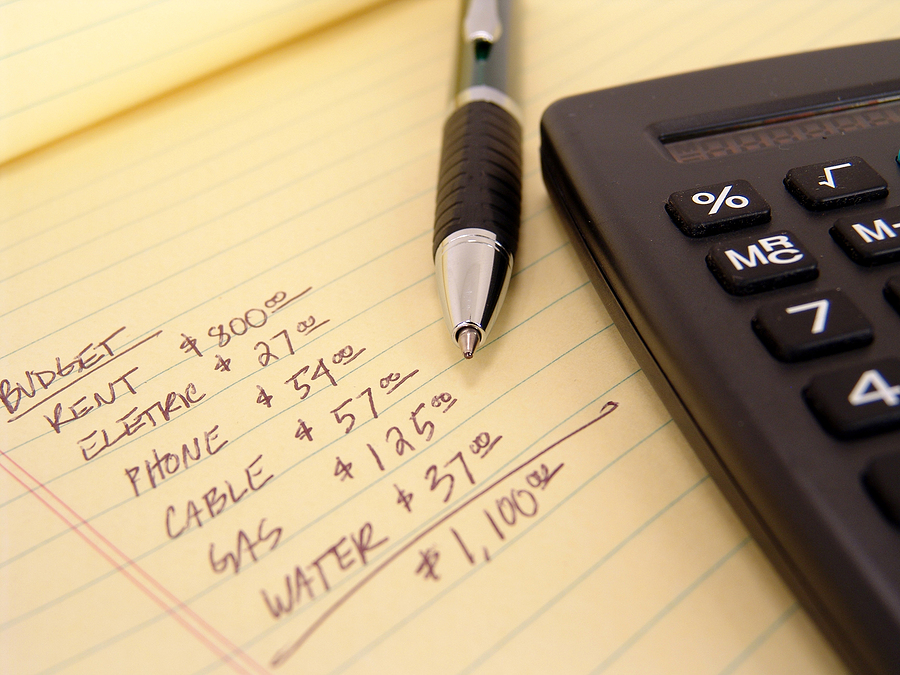

#1- Determine your new income and expenses

Are you or your partner planning on retiring soon? Has your income changed in any way? Examining your income is the first crucial step to reshaping your budget. Now that the costs associated with bringing up children have significantly decreased or disappeared entirely, it’s vital to reassess spending. For instance, consider the smaller grocery bills, no more school tuition, managed healthcare costs, or one less mobile phone on the family plan.

#2- Tackle debt

Before focusing on anything else, aim toward decreasing or paying off any existing debts. These debts may include mortgage payments, credit card debts, or loans taken out to cover education costs. Prioritizing debts can free up your income and make other financial decisions easier.

#3- Set new goals

Many new empty nesters find themselves with a surplus of money compared to their previous budget. Adjusting to your new lifestyle includes setting new goals and determining how you want to spend this ‘extra’ money. You may want to renovate your home, or you’d like to travel. Now would also be an excellent time to revisit your retirement savings plan. Should you increase your contributions? These are all great goals to consider while revising your budget.

#4- Accumulate additional emergency funds

Previously you may have experienced unexpected expenses pop up when you least expected them. As an empty nester, you’re not immune to this. You must allocate some of your income toward an emergency fund. This safety net can be vital in a crisis or if you or your spouse face unexpected health issues.

#5- Plan for future healthcare costs

It’s no secret that this expense can grow as you age, so consider this part of your revised budget. Investigate any changes in your insurance coverage, mainly looking for potential savings, given that your children are longer on your policy.

#6- Embrace minimalism

With an empty nest comes the opportunity to declutter your home and your life. Decluttering also means reassessing your spending habits and eliminating unnecessary things. A minimalist approach to your budget can help ensure you live within your means and focus on what’s truly important to you.

Revising your budget when you become an empty nester can be daunting. But if you take the time to assess your income and expenses and focus on these ideas quickly, you can navigate this transitional phase of life more successfully.

In Conclusion

Ultimately, becoming empty nesters shouldn’t be seen as a negative, regardless of much you may miss the chaos of a full house. Instead, view it as an opportunity to refocus spending and saving and set new financial goals to work toward during this exciting stage of life.

SWG3054142-0823b The sources used to prepare this material are believed to be true, accurate and reliable, but are not guaranteed. This information is provided as general information and is not intended to be specific financial or tax guidance. When you access a link you are leaving our website and assume total responsibility for your use of the website you are linking to. We make no representation as to the completeness or accuracy of information provided at this website. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website.

Integrity Financial Group South West LLC offers safe alternatives for retirement savings. Our insurance options focus on increasing spendable income, maximizing inheritance to heirs, and avoiding unnecessary taxes. Contact us today to get started on reviewing your situation.